Responsible AI is not just the right thing to do. It’s also the smart thing to do.

By Evan Ramzipoor, Workflow contributor

Last year, ServiceNow created the inaugural Enterprise AI Maturity Index to understand how AI is impacting organizations across the globe. We found that maturity levels were low across all industries, including banking. Organizations were still developing strategies to deploy generative AI (GenAI) and other emerging tools in their tech stack and operations.

This year, we surveyed almost 4,500 executives worldwide—including 477 from banks—to track how maturity levels have changed. The results are surprising. Maturity scores are lower than 2024 and banking is not immune to the slowdown.

On average, banks' maturity score dropped 10 points (from 45 to 35) on our 100-point AI maturity scale, compared to nine points for all respondents. The reason? According to industry research created in collaboration with NVIDIA, banks—like many other organizations—are hard-pressed to stay ahead of trends and integrate the technology safely and profitably as AI continues to evolve at a breakneck pace.

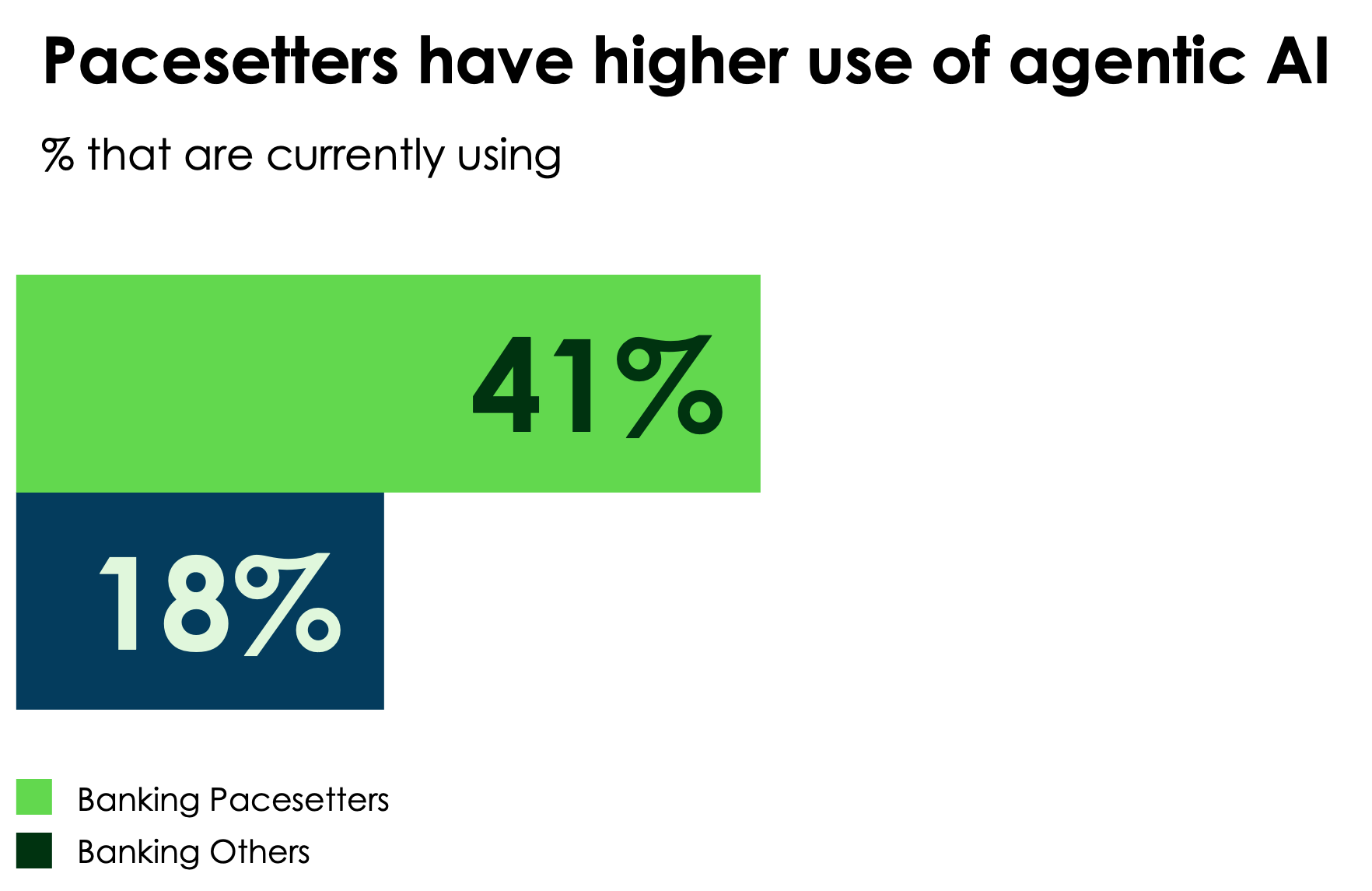

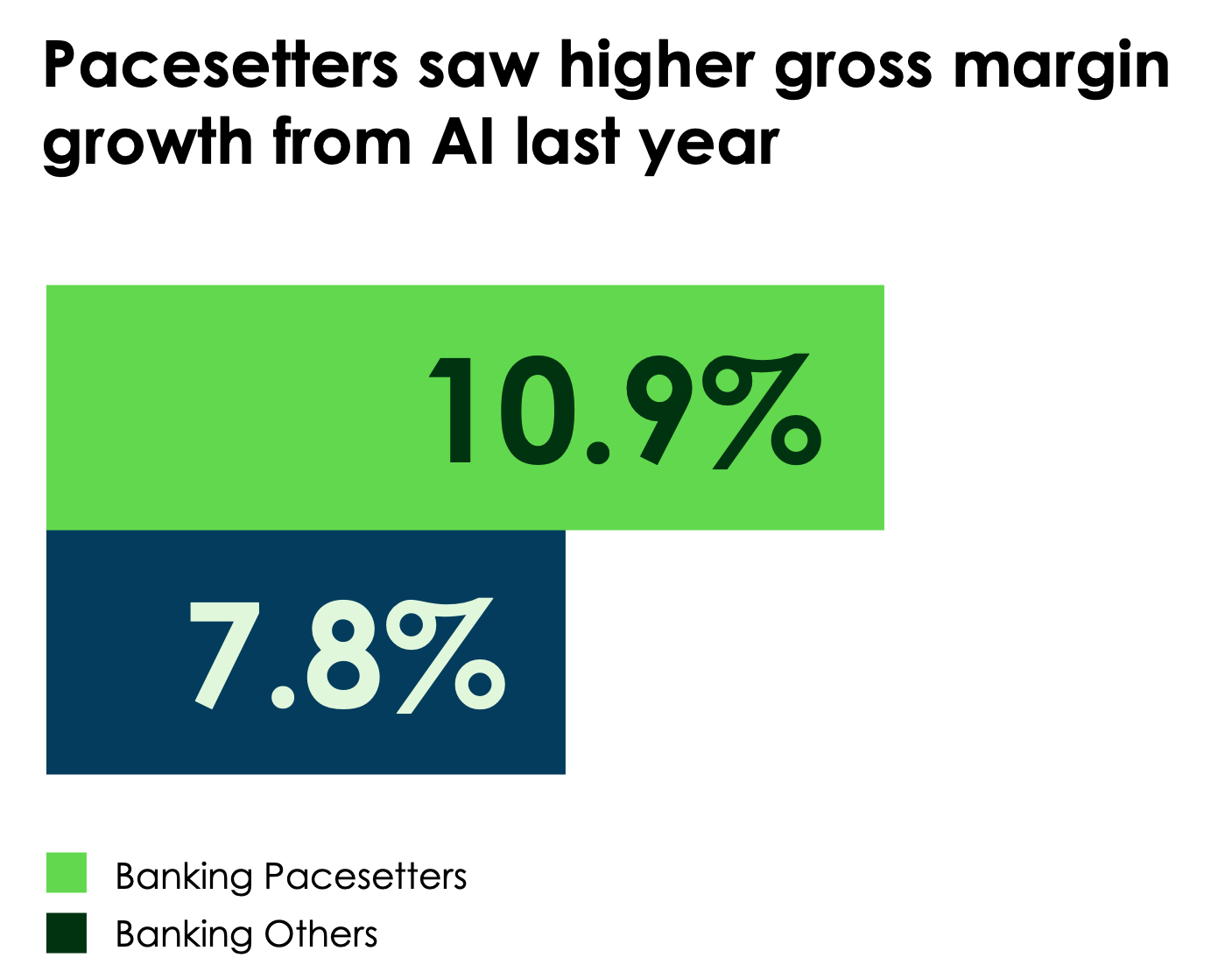

While the decline in maturity is notable, it’s not all doom and gloom. We found the banking sector is second only to the technology sector in overall AI maturity. An impressive 20% of the banks we surveyed are AI Pacesetters. This cohort has seen higher margin growth from AI than others and leads the pack across all five pillars of AI maturity: AI strategy and leadership, workflow integration, talent and skills, data governance, and realizing value in AI investment.

“Many banks had just begun implementing generative AI when agentic AI became a viable option. They are struggling to keep up,” says Gregory Kanevski, global head of banking at ServiceNow.

Regardless of size, all Pacesetters are achieving increased efficiency and productivity, and they are better able to manage risk and improve experiences than other banks we surveyed.

Here are five best practices that set Pacesetter banks apart from the rest:

SERVICENOW & NVIDIA PRESENT